I had never seen anything like it before. I was new to my teaching career and a pilot teacher in the early years of Utah’s General Financial Literacy efforts. I had an idea, but I was incredibly nervous about how it would be received by my students.

Keep in mind, my students weren’t exactly the typical high school students. I started my career at an alternative high school, where many of my kids were on their “last chance” at earning a public education. They came to our school for various reasons where the odds were stacked against them.

As I shared my lecture on cash flow, paying yourself first, tracking spending to identify areas of excess, and everything that goes with it, I could see some excitement. Students were intrigued by the Envelope System and responded to my challenge, “Just try it.”

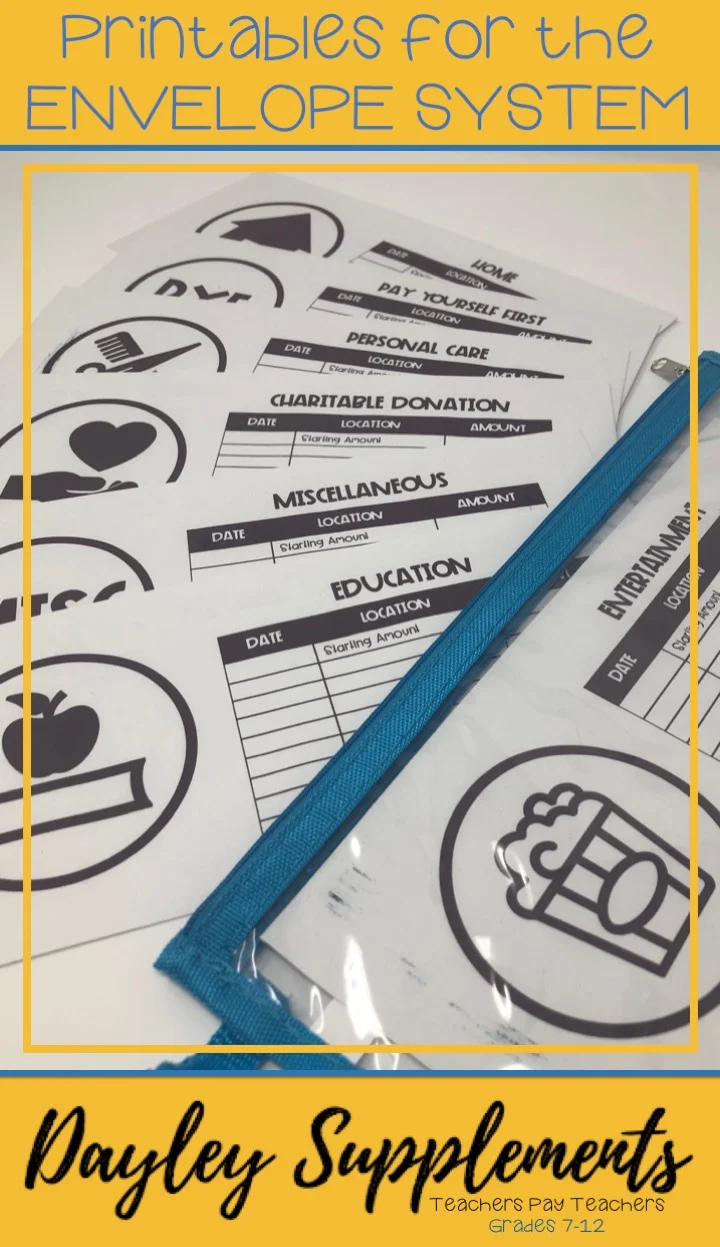

I will never forget the feeling I had when Raymond, a giant and very quiet student, came to me a few weeks after the challenge to show me his worn out envelopes. He had written on the outside of each one to identify the date, location and amount of his expenditures. The edges were work and they were starting to tear due to being minimized to the margins of his wallet. It worked. For him, it worked.

It worked for me, too! As a young married couple, I remember the tight restrictions on our budget. There was always more month than there was money! (Can I get an Amen)?! The Envelope System came to the rescue for me and my hubby as we consciously made an effort to only spend what was allotted in each envelope each month. When we ran out of cash in one envelope, money would be taken and tracked from a different envelope to make sure we never touched our savings. Our big splurge once a week was to share a Blimpee Meal Deal. The foot-long sandwich was cut in half and we shared the chips and drink. All that for $5.00!

The novelty of the Envelope System gets the attention of students and makes tracking cash flow fun. Perhaps the most beneficial takeaway is the creation of a new habit and the visualization of seeing where money is going.

Many different categories of spending are provided in this resource and not all will apply to all students. I recommend that students choose three to five categories to work with so they can enjoy the process.